Arbitrage is the transaction of buying and selling the same asset in two or more markets to profit from the difference in prices from different markets.

What is Arbitrage?

In CryptoCurrency, it is applicable to use cryptocurrencies such as Bitcoin, Ethereum, Litecoin, Bitcoin Cash,

etc... to buy and sell simultaneously at two exchanges or multiple exchanges to make a profit on the price

difference between exchange platforms.

A theoretical example of Arbitrage

Suppose at 2 exchanges with Bitcoin listing (BTC) as follows:

- Exchange A: BTC/USD = 7.729 USD

- Exchange B: BTC/USD = 7.950 USD

BTC/USD buying rate = 7,950 USD of the exchange B is greater than the buying rate of BTC/USD on the exchange A BTC/USD = 7,729 USD.

Profit opportunities are as follows:

- buy BTC at Exchange A with rate BTC/USD = 7.729 USD

- Bán BTC at Exchange B with rate BTC/USD = 7.950 USD

Thus, the profit earned from using Arbitrage is as follows: 7,950 – 7,729 = 221 USD

How to make a profit from Arbitrage?

It can be said that Arbitrage has been around for a long time, but recently the market "was up" with forms of making money or investing in trusts in companies and projects that are using Bot Arbitrage.

The example above has helped you imagine how profit-making from Arbitrage is, right?

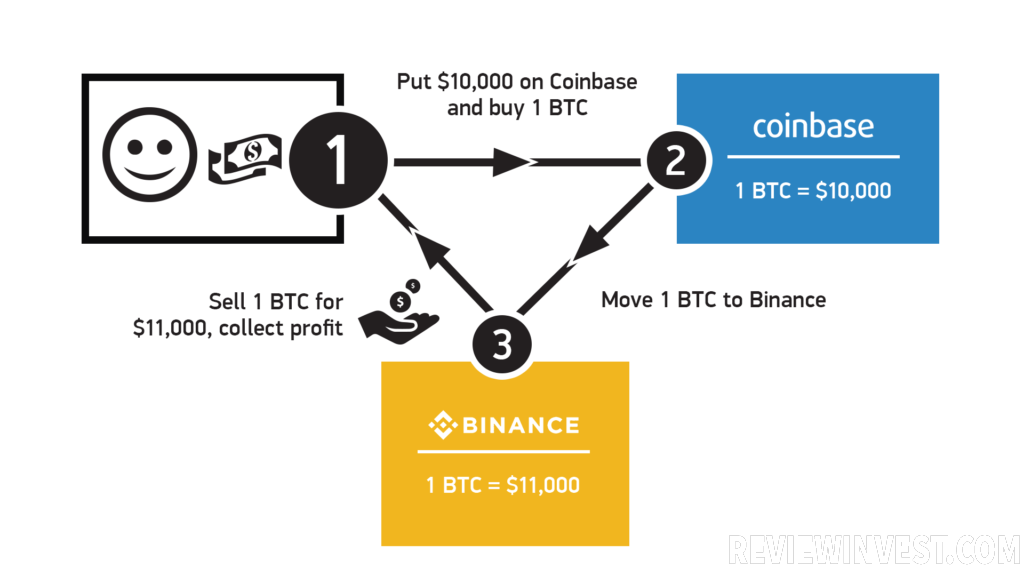

Use Arbitrage on Coinbase and Binance

However, to make money from Arbitrage, we need to have the following:

- Get the crypto price you want to use from the lowest and highest exchanges.

- Fast processing time because the process takes place at the same time: BUY – SELL

- Significant capital because available assets are needed to execute trades on exchanges